Living off existing assets and boosting super at the same time

This case study shows you how careful planning and quality advice can really make a difference to your super.

This case study shows you how careful planning and quality advice can really make a difference to your super.

Richard is 39 years old and recently received a large inheritance of $150,000 from his aunt in the United Kingdom.

He is keen to make the most of the money but is worried about how to invest it in the most tax effective way. He’s also very focused on boosting his superannuation savings at the same time.

His marginal tax rate (MTR) is 41.5% (including the Medicare levy) and as a self-employed person, he is currently contributing $20,000 each year as tax-deductible (concessional) contributions into superannuation. As a 39 year old, he is entitled to a concessional contribution cap of $50,000 a year before his concessional contributions are subject to penalty rates of tax. Contributions within this cap are only taxed at a maximum of 15%. This means that at the moment, he is not using $30,000 of his concessional contributions cap.

What should he do?

There are three options that Richard can choose from to invest his inheritance. He can:

Option #1: Invest outside of superannuation and continue with his current superannuation contribution arrangements

Option #2: Invest inside superannuation as a one-off personal after tax (non-concessional) contribution

Option #3: Invest outside of superannuation and increase the amount of his concessional (tax-deductible) contributions. He could increase his contributions by $30,000 (or $17,550 net income on the 41.5% MTR). He would then need to draw from his invested inheritance to meet his living expenses.

Richard chooses option #3, which will make the most of his concessional contributions cap. Because he will be drawing down on his inheritance money invested outside superannuation to meet his living expenses, this strategy will free up his cash flow. He’ll be able to add more to his super through additional tax-deductible (concessional) contributions.

Option #3 will also give him a number of valuable tax benefits:

- The pre-tax superannuation contributions will help to reduce his personal income tax.

- He’ll pay less tax on his investment earnings. This is because there is a maximum 15% tax on superannuation fund investment earnings (10% on capital gains) compared to individual marginal tax rates of up to 45% on investment assets held outside superannuation.

- He won’t pay any tax when he eventually withdraws his superannuation benefits as a lump sum or pension once he reaches 60 years of age.

Understanding Richard’s options

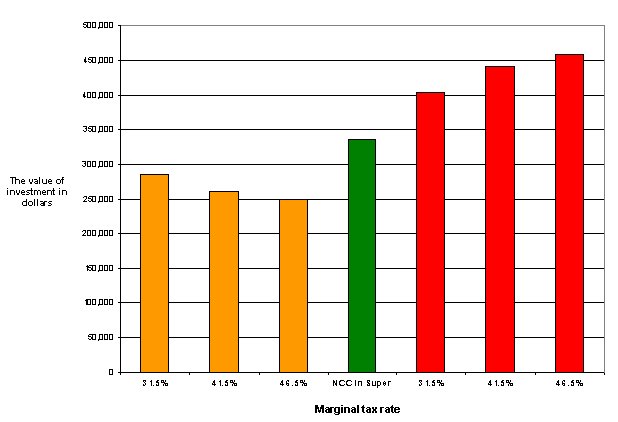

The chart below shows how the different strategies would perform after 10 years.

Option #1: The first three columns of the chart in yellow show how much Richard’s inheritance would have grown if he had invested it outside super. They show the results at each different marginal tax rates. At Richard’s MTR of 41.5% (the second column on the left), his inheritance would have grown to $261, 678.

Option #2: The middle column in green (NCC in super) shows what would have happened if Richard had invested his inheritance into super as a non-concessional contribution. His inheritance would have grown to $336,699.

Option #3: The last three columns on the right in red show the results of the recommended strategy at different marginal tax rates. The second column from the right (at 41.5% MTR) is the column that shows how Richard’s inheritance would have performed if he implements option#3. The value of his inheritance has effectively grown to $441,164.

Investment assumptions (gross return per annum)

- Income: 3% (70% Franked) - Reinvested after paying income tax

- Growth: 5.5%

- CGT is payable at end of relevant period

Important information

The information in this article does not take into account your objectives, financial situation or needs. Therefore, before acting on the information, you should consider its appropriateness to your personal circumstances. Although this information was obtained from sources considered to be reliable, it is not guaranteed to be accurate or complete. This publication was prepared by AMP Financial Planning Pty Limited ABN 89 051208327. The information is current as at 4 March 2008 and may change over time.